Calculate 2019 tax return

This is the form that most use when they are filing. Calculate the total income taxes of the Ontario residents for 2019.

Tax Schedule

Use the PriorTax 2019 tax calculator to find out your IRS tax refund or tax due amount.

. Your taxable income is in the appropriate income range. Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. Please note this calculator is for the 2019 tax year which is due in 2020.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Including the net tax income after tax and the percentage of tax.

If based on your 2020 tax returns you would be entitled to a larger payment than calculated based on your 2019 returns you will be eligible to receive the difference as a tax. We also offer calculators for the 2012 2013. Valid for an original 2019 personal income tax return for our Tax Pro Go service only.

Ad Prevent Tax Liens From Being Imposed On You. Just answer a few simple questions about your life income and expenses and our free tax. Ad Prevent Tax Liens From Being Imposed On You.

Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify. Please choose your province based. Because tax rules change from year to year your tax refund.

Maximize Your Tax Refund. Start with the free 2019 Tax Calculator and estimate your 2019 IRS Return. Determine who can qualify as a Qualified Dependent on 2019 IRS Tax Returns.

How will you be filing your tax return. Include your income deductions and credits to calculate. Maximize Your Tax Refund.

CPA Professional Review. 2019 Tax Year Calculators Forms. Click for the 2019 State Income Tax Forms.

When done with the above RATEucator use the 2019 Tax Calculator and Refund Estimator for more of your accurate personal detailed tax return information. Ad With TurboTax Its Fast And Easy To Get Your Taxes Done Right. And is based on the tax brackets of 2021.

It is mainly intended for residents of the US. Single Married Filing Jointly Married Filing Separately Head of Household Qualifying Widower What was your age on December 31. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Even though you can no longer e-File a 2019 Returns but can still calculate or prepare the 2019 FormsYou can. Up to 10 cash back Return Status Check E-file Status Track IRS Refund Tax Tools Tax. Include your 2019 Income Forms with your 2019 Return.

Here are over 10 more 2019 Tax Calculator tools that give you direct answers on your. Tax province is chosen by where you lived as of December 31. CPA Professional Review.

Ad Find 2019 Irs Tax Calculator. As announced in the 202223 federal Budget the low and middle income tax offset has been increased by 420 for the 202122. Dont Put It Off Any Longer.

That is the 1040 form. Get Previous Years Taxes Done Today With TurboTax. With our easy to use Tax Calculator you are able to estimate your tax based on your province.

To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Your household income location filing status and number of personal exemptions. You can no longer e-File Tax Returns for Tax Year 2019 Jan.

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. Effective tax rate 172. The period reference is from january 1st 2019 to.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. The IRS online income tax calculator is an especially useful resource according to tax planners since it makes it easier to navigate rule changes from the Tax Cuts and Jobs Act. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Tax Schedule

:max_bytes(150000):strip_icc()/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Average Tax Rate Definition Taxedu Tax Foundation

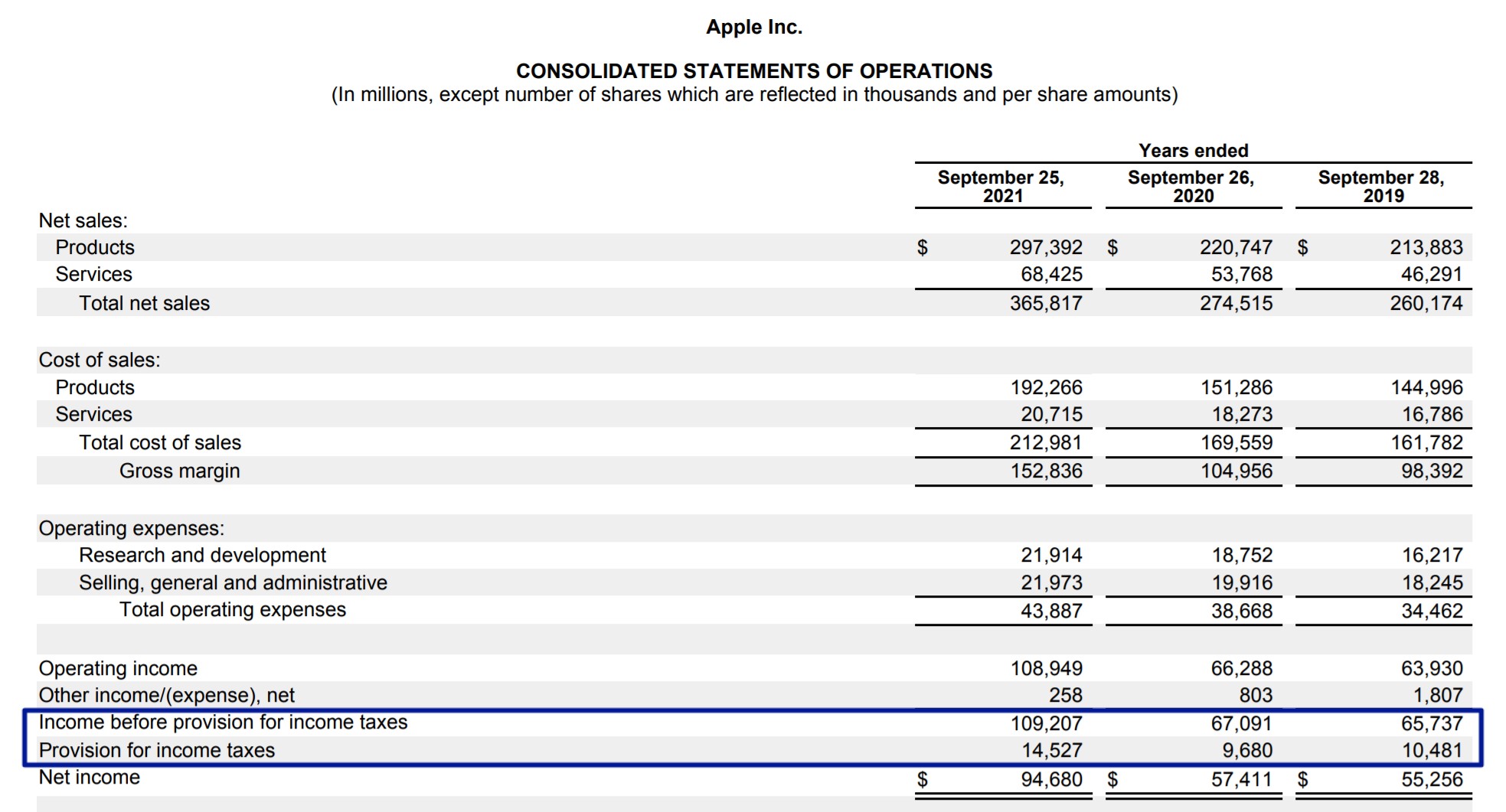

How To Calculate Federal Income Tax

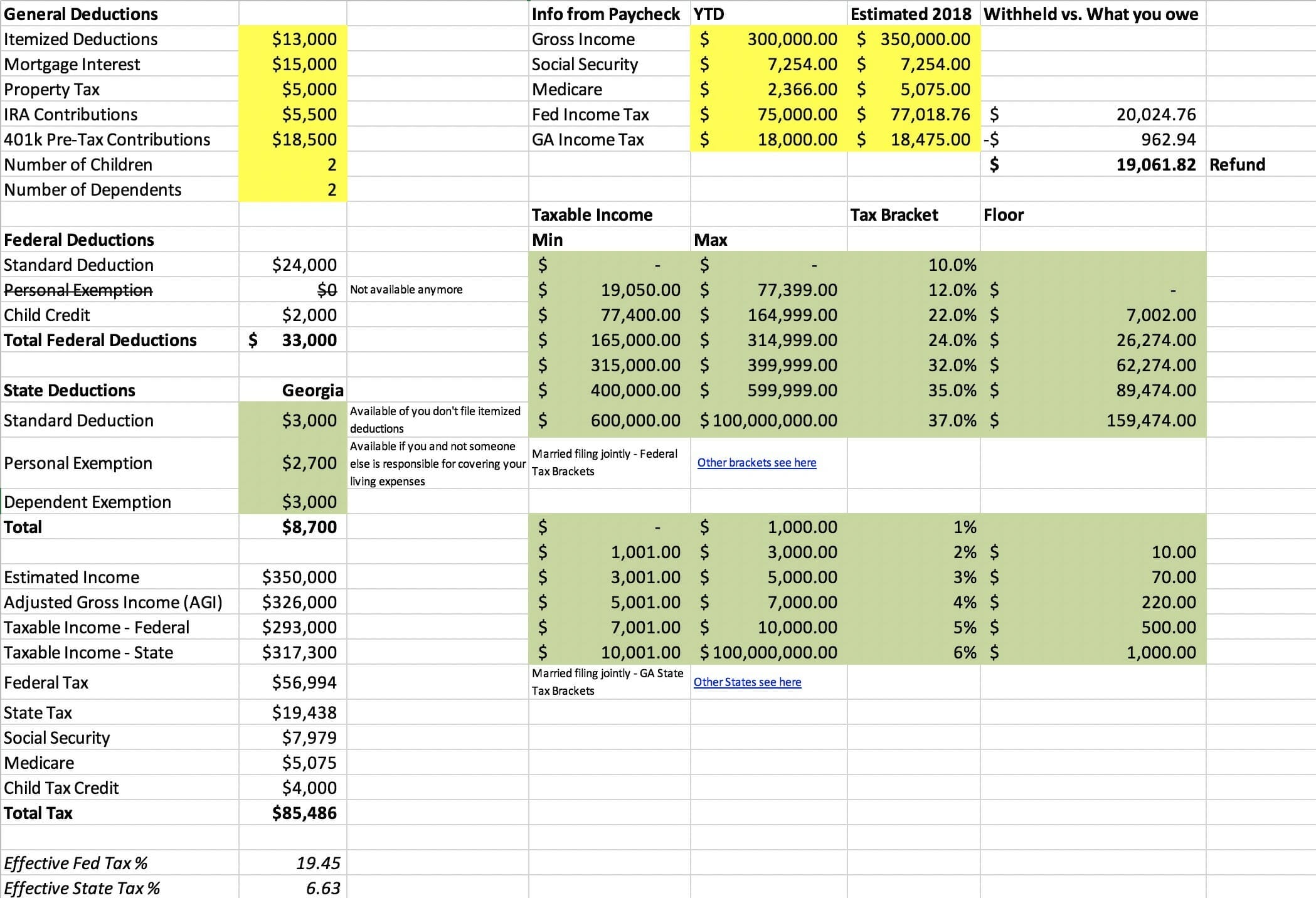

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Federal Student Aid

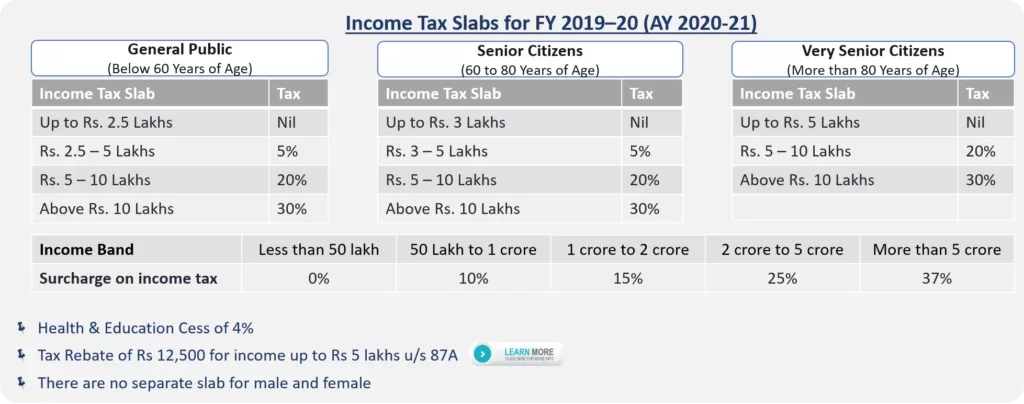

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Excel Formula Income Tax Bracket Calculation Exceljet

Tax Schedule

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How To Calculate 2020 Federal Income Withhold Manually With New 2020 W4 Form

Effective Tax Rate Formula And Calculation Example

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download